How it works

Your PDF Document

Print, and Share

It Legally Binding

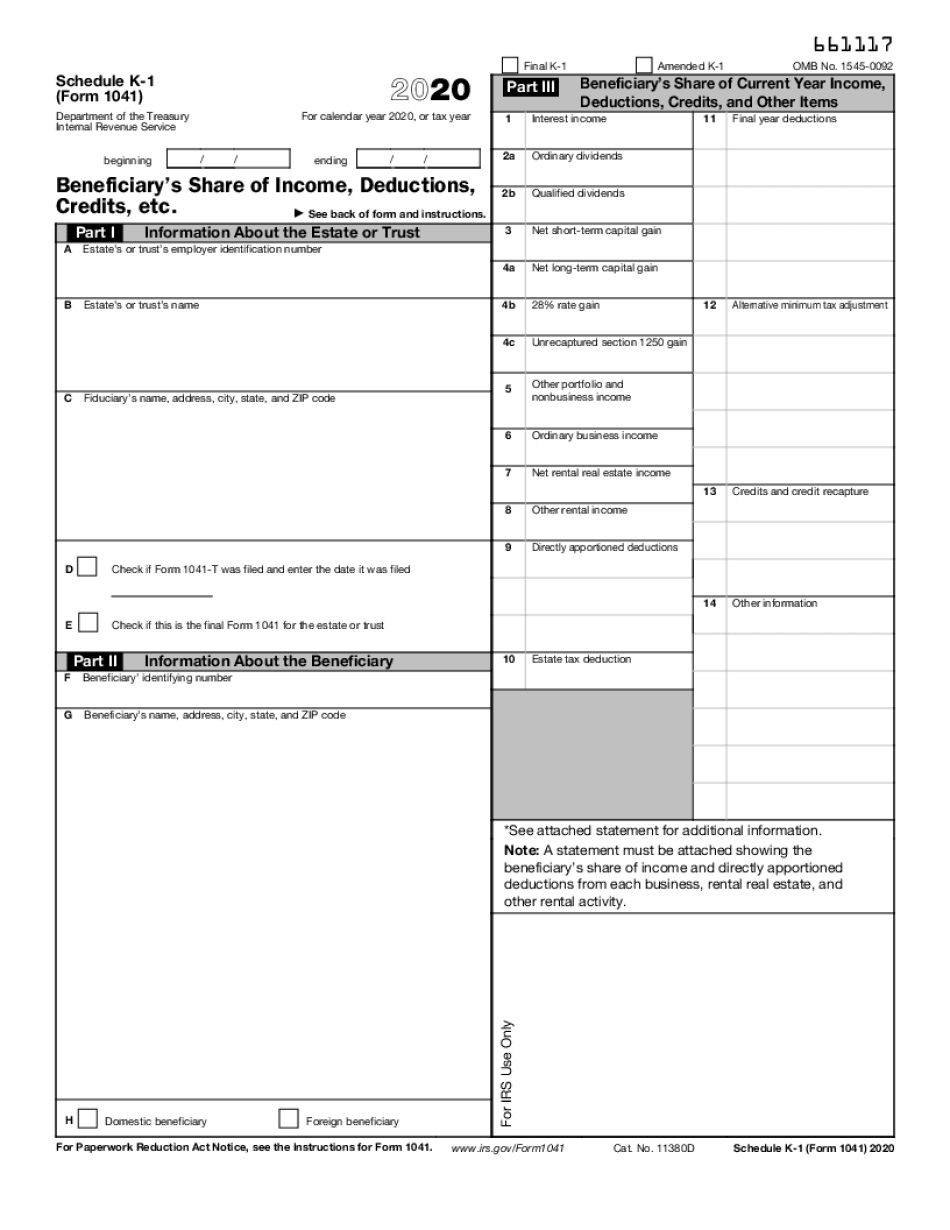

What is Schedule K 1 Form 1041?

You must report all dividend income on the 1041, and you report the share of dividend income for each beneficiary on Schedule K-1s. You must furnish a copy of each K-1 to the appropriate beneficiary, and attach all copies to Form 1041 when you file the return with the Internal Revenue Service.

How to Combine and Reorder in Schedule K 1 Form 1041

Work on documents online hassle-free, leaving software installation, downloads, and other follow-ups behind. Our web-based editor offers you all the tools you might need to enhance records. Using the solution, you can manage, modify, and Combine and Reorder in Schedule K 1 Form 1041 without extra steps. Follow the guidelines below to check it out and find out more benefits:

Make the most out of the service to put in order a flexible editing workflow. Process documents and Combine and Reorder in Schedule K 1 Form 1041 in clicks using the cross-platform solution from any device. Now, to cope with the paperwork and burdensome tasks, you need only a strong internet connection. Throw the piles of papers that clutter your workplace away and keep all files at your fingertips from anywhere, anytime.

Advantages to Combine And Reorder In Schedule K 1 Form 1041 here

Don't waste time comparing a dozen solutions. Try our service and find out how to Combine And Reorder In Schedule K 1 Form 1041 in the most straightforward way. You can get access to the toolkit and say goodbye to all PDF-related issues. Our online solution helps you edit content as you like seamlessly and create good-looking documents via your device without extra software. Build a workflow where you can feel free to focus on important things for you and your business while our platform supplies you with everything else: